Now, was that so hard?

Update: I was told

|

| The Wiz |

|

| God, I wish I knew how to quit you! |

|

| Hippie life in Marin County in the 1970s |

| Sermon on the Mount |

|

| The Road Not Taken |

One of the two parties already occupies the approximate ideological space that these commentators themselves are describing as the dream middle ground that allegedly can only be staked out by a third party.

That party is known as the “Democratic Party,” and it alreadly holds many of the positions these commentators want a third party to espouse.

|

| George and Mitt Romney |

|

| G. Khan, Republican |

|

| Troy Davis, scheduled to die as I type this. |

|

| Adam Smith's "invisible hand" -- real or an hallucination? |

|

| John D. Rockefeller |

|

| Morning market, Wajima, Japan, 2011 |

|

| Click for larger version |

|

| Companies sitting on piles of cash. |

|

| Click for larger view |

Income inequality in the United States has not worsened steadily since 1915. It dropped a bit in the late teens, then started climbing again in the 1920s, reaching its peak just before the 1929 crash. The trend then reversed itself. Incomes started to become more equal in the 1930s and then became dramatically more equal in the 1940s. Income distribution remained roughly stable through the postwar economic boom of the 1950s and 1960s. Economic historians Claudia Goldin and Robert Margo have termed this midcentury era the "Great Compression." The deep nostalgia for that period felt by the World War II generation—the era of Life magazine and the bowling league—reflects something more than mere sentimentality. Assuming you were white, not of draft age, and Christian, there probably was no better time to belong to America's middle class.

The Great Compression ended in the 1970s. Wages stagnated, inflation raged, and by the decade's end, income inequality had started to rise. Income inequality grew through the 1980s, slackened briefly at the end of the 1990s, and then resumed with a vengeance in the aughts. In his 2007 book The Conscience of a Liberal, the Nobel laureate, Princeton economist and New York Times columnist Paul Krugman labeled the post-1979 epoch the "Great Divergence."

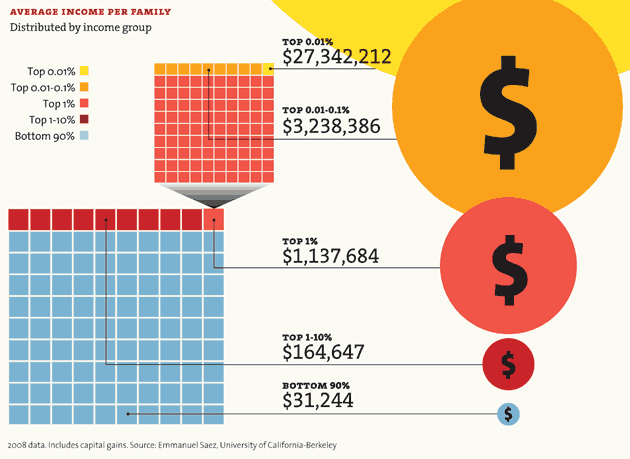

A look at the chart below shows that the average citizen is not only scratching his head but also often blissfully ignorant of the true state of things in our economy:It's generally understood that we live in a time of growing income inequality, but "the ordinary person is not really aware of how big it is," Krugman told me. During the late 1980s and the late 1990s, the United States experienced two unprecedentedly long periods of sustained economic growth—the "seven fat years" and the "long boom." Yet from 1980 to 2005, more than 80 percent of total increase in Americans' income went to the top 1 percent. Economic growth was more sluggish in the aughts, but the decade saw productivity increase by about 20 percent. Yet virtually none of the increase translated into wage growth at middle and lower incomes, an outcome that left many economists scratching their heads.

|

| Click for larger view |

Lane notes that many companies were unable to get credit during the last financial crisis, and they're trying to be more prudent about how they spend money now.

"So I think one of the reasons that is contributing to many companies holding onto cash would be the very vivid memories of the severity of the downturn that commenced in mid-2008," he says.

Companies can borrow money very cheaply right now, so instead of paying off their debts, they can sit on cash as long as possible. But there's a more basic reason companies are hoarding money: The U.S. economy simply isn't growing enough.

If, then, we've got this divergence of reality in which the wealthy have money falling out of their pockets and the Fortune 500 companies are bursting with cash and yet we're bleeding jobs all over the place, something about Conservative Dogma 101 isn't exactly ringing true.The labor market is weak, which hampers consumption, notes Charles Biderman, chief executive officer of the research firm TrimTabs. "So without growing income, where's the money to buy more stuff?" he says. "Absent a change in demand, the fact that companies have all this cash, well, good for them. It's not going to help us."

The uncertainty meme is just mind boggling. Businesses always have a certain amount of regulatory uncertainty to deal with, and there's simply no evidence that this uncertainty is any greater now than it usually is. (It is, of course, entirely believable that business owners who spend too much time watching Fox or reading the Wall Street Journal editorial page might believe otherwise, but that's a whole different problem — and one that Imrohoroglu should spend his time debunking, not promoting.) The only significant real uncertainty that American businesses face right now is financial uncertainty: that is, whether there will be enough consumer demand next year to justify hiring more workers and buying more equipment today. PPACA and carbon taxes rank very far down the list.Next, let's have Matt Yglesias react:

Policymakers can’t make it cease to be the case that the future is uncertain. Policymakers can observe, however, that if economic actors’ level of uncertainty about the future increases that would manifest itself as an increased demand for money. Increased demand for money is a funny beast. Normally if demand for one kind of good or service falls, demand for other goods or services has to rise. But if what people demand is money itself then we find ourselves mired in a general glut, a shortfall of aggregate demand. Which is to say you’d be in just the normal Keynesian situation and you’d want to get out of it in just the normal Keynesian way—looser monetary and fiscal policy to bolster aggregate demand, soak up the excess capacity, and return us to a low-idleness equilibriumFinally, let's hear it from Dean Baker:

The NYT told readers that the Obama administration wants to increase the demand for goods and services, "which could then give employers the confidence to hire." Actually, an increase in the demand for goods and services forces employers to hire at the risk of losing business.

If a restaurant doesn't have enough staff to serve its customers, it will lose customers. If a factory doesn't have enough workers to fill its order then it loses orders. Increased demand forces businesses to use more labor.

Confidence may affect the extent to which firms actually hire more workers, as opposed to increasing the number of hours worked per worker. The latter still remains well below its pre-recession level. This is a strong piece of evidence that a lack of demand, not confidence, is the main factor impeding business expansion.One final hammer, Bruce Bartlett with his It's the Aggregate Demand, Stupid. Yeah, Bruce Bartlett who worked for Reagan and Bush I. Who needs Paul Krugman when you've got conservatives (old school) on your side? (Sorry, sneaked that in.)

|

| In other words, since 2009 businesses cite "Poor Sales" most, meaning low demand! |

Graham: When you pick one area of the economy and you say we're gonna tax those people because most people aren't those people, well, then that's class warfare.

(ABC News) The White House outlined $467 billion in savings to pay for the American Jobs Act through a series of tax policy changes, Office of Management and Budget Chair Jack Lew announced Monday at the White House daily briefing. While the president’s bill has a $447 billion price tag, Lew explained that the extra $20 billion is designed as a cushion to ensure the bill is “fully paid for” as the president has repeatedly promised.

Among the offsets suggested by Lew:

– New limits on deductions for income over $250,000. This would raise $400b over ten years.

– New formulas for taxing the income of hedge fund managers’ could raise $18 billion.

– Oil and gas measures, Lew said, would raise $40 billion.

– Limiting tax deductions for corporate jets would raise $3 billion.

The president hopes the special congressional supercommittee already searching for $1.5 trillion in deficit reduction will “overachieve” and consider these proposals or find different means of offsetting the nearly half a trillion he needs to pay for a job creation bill.John Boehner wasted little time shooting down both the jobs plan and Obama's way of paying for it:

Republicans have already said they do not support many elements of Obama's $447 billion jobs package and will not back the tax increases he has proposed to pay for it.

Boehner's comments indicated that the bill is unlikely to emerge from Congress in anything like its current form.

Even as Boehner said there were some opportunities for common ground, he indirectly criticized the temporary tax breaks that other senior Republicans had said they might support.

Boehner attacked "short-term gimmicks" and said a proposed tax credit for businesses that hire new workers would have little impact if employers were worried about other government policies. Washington's energies would be better channeled toward reducing regulations on business, he said.

"Let's be honest with ourselves. The president's proposals are a poor substitute for the pro-growth policies that are needed to remove barriers to job creation in America," he told the Economic Club of Washington.

Boehner said a newly created committee of Democrats and Republicans should try to simplify the tax code as it works to trim at least $1.2 trillion from annual budget deficits over 10 years.

But that overhaul should not bring more revenue to the government and the committee should focus only on spending cuts and benefit reforms to trim deficits, Boehner said.