|

| Companies sitting on piles of cash. |

Every conservative on message has been maintaining for almost as long as Barack Obama has been in office that the real job creators are the rich folks on whom Obama has tried but failed to raise taxes. Since he hasn't managed to raise their taxes, and especially since many large-cap companies in a whole host of different sectors are sitting on wads of cash, some $1.26 trillion and counting, I have to wonder just what the conservatives' message actually means.

We all know that according to every Republican Congressional leader and every Republican candidate for president, the real job creators are the wealthy who spur growth and thus new jobs through investments. And since they own the vast majority of stock in the Fortune 500 companies, they hold, as stockholders, vast sway over the decisions these companies make.

So here's my question: if we're in this near-perfect storm of the wealthy in America accumulating wealth at a faster clip that perhaps anytime since 1929 along with corporations with their coffers filled to bursting, why aren't jobs being created all over this country? Where are the jobs?

Come on people, this is Conservative Dogma 101. The wealthiest in this country are the job creators and tax increases are the dirty, filthy job killers -- and there aren't any tax increases -- so why aren't jobs bursting out all over the place?

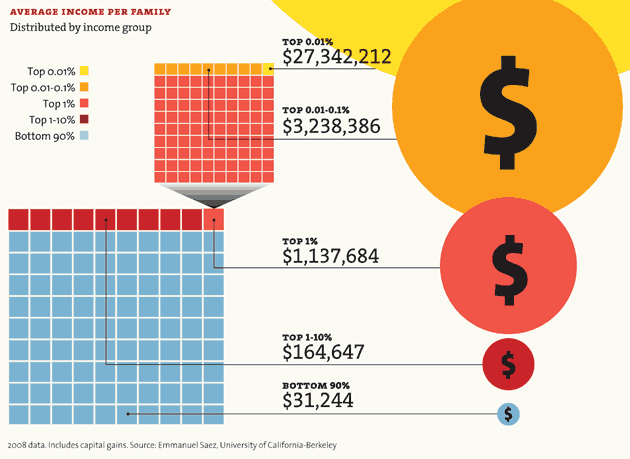

Look at this chart showing the accumulation of wealth at the top of the American food chain:

|

| Click for larger view |

Timothy Noah at Slate explains how the growing wealth gap has become what it is today:

Income inequality in the United States has not worsened steadily since 1915. It dropped a bit in the late teens, then started climbing again in the 1920s, reaching its peak just before the 1929 crash. The trend then reversed itself. Incomes started to become more equal in the 1930s and then became dramatically more equal in the 1940s. Income distribution remained roughly stable through the postwar economic boom of the 1950s and 1960s. Economic historians Claudia Goldin and Robert Margo have termed this midcentury era the "Great Compression." The deep nostalgia for that period felt by the World War II generation—the era of Life magazine and the bowling league—reflects something more than mere sentimentality. Assuming you were white, not of draft age, and Christian, there probably was no better time to belong to America's middle class.

The Great Compression ended in the 1970s. Wages stagnated, inflation raged, and by the decade's end, income inequality had started to rise. Income inequality grew through the 1980s, slackened briefly at the end of the 1990s, and then resumed with a vengeance in the aughts. In his 2007 book The Conscience of a Liberal, the Nobel laureate, Princeton economist and New York Times columnist Paul Krugman labeled the post-1979 epoch the "Great Divergence."

A look at the chart below shows that the average citizen is not only scratching his head but also often blissfully ignorant of the true state of things in our economy:It's generally understood that we live in a time of growing income inequality, but "the ordinary person is not really aware of how big it is," Krugman told me. During the late 1980s and the late 1990s, the United States experienced two unprecedentedly long periods of sustained economic growth—the "seven fat years" and the "long boom." Yet from 1980 to 2005, more than 80 percent of total increase in Americans' income went to the top 1 percent. Economic growth was more sluggish in the aughts, but the decade saw productivity increase by about 20 percent. Yet virtually none of the increase translated into wage growth at middle and lower incomes, an outcome that left many economists scratching their heads.

|

| Click for larger view |

Rick Lane, a senior vice-president at Moody's, explains the business climate in a recent NPR report:

Lane notes that many companies were unable to get credit during the last financial crisis, and they're trying to be more prudent about how they spend money now.

"So I think one of the reasons that is contributing to many companies holding onto cash would be the very vivid memories of the severity of the downturn that commenced in mid-2008," he says.

Companies can borrow money very cheaply right now, so instead of paying off their debts, they can sit on cash as long as possible. But there's a more basic reason companies are hoarding money: The U.S. economy simply isn't growing enough.

The labor market is weak, which hampers consumption, notes Charles Biderman, chief executive officer of the research firm TrimTabs. "So without growing income, where's the money to buy more stuff?" he says. "Absent a change in demand, the fact that companies have all this cash, well, good for them. It's not going to help us."If, then, we've got this divergence of reality in which the wealthy have money falling out of their pockets and the Fortune 500 companies are bursting with cash and yet we're bleeding jobs all over the place, something about Conservative Dogma 101 isn't exactly ringing true.

Anybody have a different view? Or should we stop listening to these charlatans and start listening to different voices?

Update: Okay, I left out -- with reason -- the common fallback conservative position: It's the uncertainty, stupid. First, Kevin Drum:

The uncertainty meme is just mind boggling. Businesses always have a certain amount of regulatory uncertainty to deal with, and there's simply no evidence that this uncertainty is any greater now than it usually is. (It is, of course, entirely believable that business owners who spend too much time watching Fox or reading the Wall Street Journal editorial page might believe otherwise, but that's a whole different problem — and one that Imrohoroglu should spend his time debunking, not promoting.) The only significant real uncertainty that American businesses face right now is financial uncertainty: that is, whether there will be enough consumer demand next year to justify hiring more workers and buying more equipment today. PPACA and carbon taxes rank very far down the list.Next, let's have Matt Yglesias react:

Policymakers can’t make it cease to be the case that the future is uncertain. Policymakers can observe, however, that if economic actors’ level of uncertainty about the future increases that would manifest itself as an increased demand for money. Increased demand for money is a funny beast. Normally if demand for one kind of good or service falls, demand for other goods or services has to rise. But if what people demand is money itself then we find ourselves mired in a general glut, a shortfall of aggregate demand. Which is to say you’d be in just the normal Keynesian situation and you’d want to get out of it in just the normal Keynesian way—looser monetary and fiscal policy to bolster aggregate demand, soak up the excess capacity, and return us to a low-idleness equilibriumFinally, let's hear it from Dean Baker:

The NYT told readers that the Obama administration wants to increase the demand for goods and services, "which could then give employers the confidence to hire." Actually, an increase in the demand for goods and services forces employers to hire at the risk of losing business.

If a restaurant doesn't have enough staff to serve its customers, it will lose customers. If a factory doesn't have enough workers to fill its order then it loses orders. Increased demand forces businesses to use more labor.

Confidence may affect the extent to which firms actually hire more workers, as opposed to increasing the number of hours worked per worker. The latter still remains well below its pre-recession level. This is a strong piece of evidence that a lack of demand, not confidence, is the main factor impeding business expansion.One final hammer, Bruce Bartlett with his It's the Aggregate Demand, Stupid. Yeah, Bruce Bartlett who worked for Reagan and Bush I. Who needs Paul Krugman when you've got conservatives (old school) on your side? (Sorry, sneaked that in.)

|

| In other words, since 2009 businesses cite "Poor Sales" most, meaning low demand! |

No comments:

Post a Comment