|

| My austerity program is ruining our economy. Thumbs up! |

His prescription was so conspicuously wrong that he was forced to rewrite the speech within hours of a draft being circulated. "That's why households are paying down their credit card and store card bills," Cameron will now say. Big whoop. He changes it to a fait accompli instead of a recommendation.

|

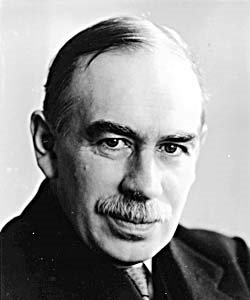

| John Maynard Keynes |

I have trouble with this in several ways. If paying down debt lowers consumption, then the economy will in fact slow because of decreased aggregate demand, leading to increased unemployment, leading to even lower demand. The result will be a labor class unable to either consume or pay down debt, let alone increase savings. If indeed the lower demand, matched by lower output, leads to lower prices, even outright deflation, then debt begins to be in real terms more expensive to pay off. This is the very definition of a vicious circle. Even if a citizen was able to remain employed without a pay cut and managed to put some amount into savings, the lower interest rates would reduce the value of savings. Lower value of savings + falling prices = a reason to spend, not save.

If you go into debt during a deflationary cycle, your subsequent debt will be easier to pay off during an inflationary cycle.

|

| Friedrich Hayek |

Sticky prices come into play here. Prices aren't fixed in anything resembling a rational or efficient way, with prices for goods remaining high when the underlying commodity prices fall. Gas prices rising fast when oil prices rise but gas prices falling more slowly when oil prices fall are good examples of price stickiness, especially to the detriment of consumers.

My experience in the last 10 years as a teacher tells me that wages, though often thought to be as sticky as prices, have stopped being so. Raises are fewer and farther in between, and the real culprit has been benefits, with the cost of health care -- and employee contributions thereto -- rising rapidly. Over time, my wages haven't kept up with prices. And I've watched my savings and investments remain flat or worse.

I get confused easily by all this, but to summarize:

- Recommending austerity during a time of flagging demand invites further shrinking of economies, leading to a downward spiral.

- Recommending the paying down of debt when debt is cheap is counterproductive.

- Recommending increasing savings at a time of rock-bottom interest rates seems also counter-productive.

- Encouraging practices that lead to decreased demand will lead to lower consumption and higher unemployment, leading to more of the same.

- Asking individuals to follow prescriptions for austerity might make marginal sense, depending on the circumstances. Asking whole nations to do it during ravaging economic times is the height of insanity.

|

| I love wars, but I hate paying for them! (Let's not, and say we did.) |

No comments:

Post a Comment